📈 ES Futures Weekly Recap & Outlook: BIG Picture Setup for Next Week

We are in the middle of a big range and watching for the next large market move on Monday.

Weekly Recap: Patience Rewarded, Both Long & Short

This past week was a solid one for traders who remained patient and disciplined. While the market offered opportunities on both the long and short side, it demanded selectivity — and punished overtrading.

The real edge came from waiting for high-quality signals to line up within a broader structure that continues to set the stage for a major move. Which is really the same as any other week; bigger time frame context helps propel smaller time frame setups ands improve odds of success.

Whether you’re trading bigger time frames or smaller, this week coming should be a good one, read on to find out why.

Standout setups this week included:

A two day range break down from Monday and Tuesday, unfortunately, this move happened after the session break on Tuesday evening following some news, so you would have had to be positioned into Tuesdays close to catch the early move here. However, there was another opportunity on Weds.

A midday short on Wednesday (red circle). After several failed flags at 3am and 11am, structure built into a clean setup for a continuation lower. This setup had multi-time frame context across bigger time frames giving it a high probability of success (15min chart look below, but see the 4 hour chart for bigger picture context and breakdown/sell signal under 5348.50). I didn’t get a valid trigger on this one to join the short side, likely because Powell speaking at 130pm, but it was structurally a good setup and broke a little earlier, likely due to the fed speak:

A long bounce off the 5252 flush, clearing out last Friday’s longs (see 4HR chart breakout and low from Fri) before triggering a reversal (green circle). This is a go-to setup for long after clearing liquidity from prior days or weeks longs (if I get a valid intraday signal to confirm the trade. In this case, I did just 6 points from the lows risking off the lows)

And finally, a clean long trigger on Friday over 5292, which offered a low-risk entry with follow-through into resistance. The bias was short Friday morning, but didn’t provide the go-to setup for me.

This long / bounce trigger was the same setup as on Weds, after clearing overnight longs under their clear stops at 5292 (the only support / higher low on the chart from Weds). These obvious levels often serve as good reversal points, however, you need to have a well back-tested system to know how to properly time these trades and manage them. Trying to catch tops and bottoms is a tough game, and takes a lot of experience and a good system. For most, its best to wait for the bounce to happen and a setup to confirm it.

Now, lets get to the good stuff. Next week is going to be a big week for trading, below I will explain why.

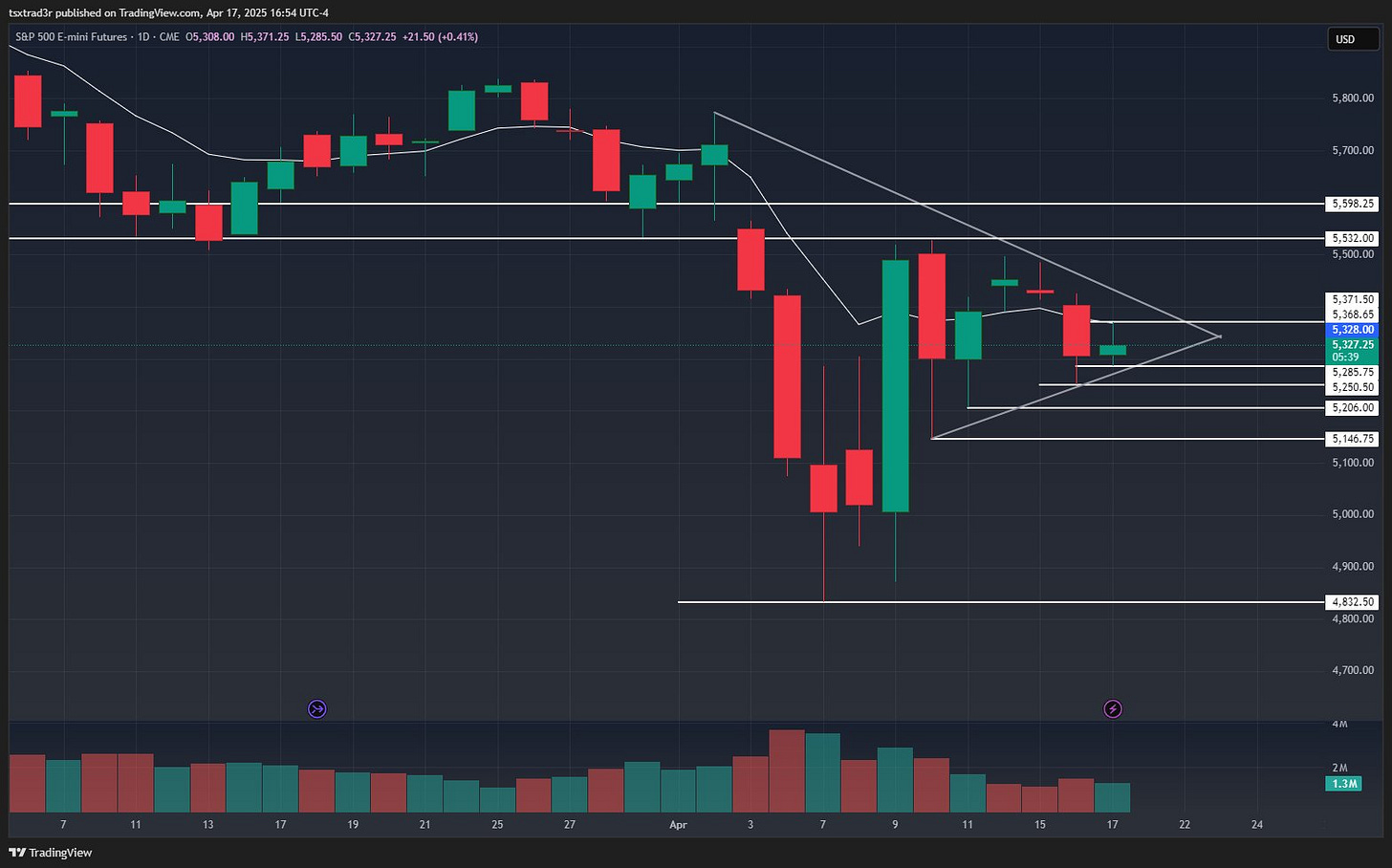

Big Picture: Coiled and Ready

For the last 10 days, ES has been consolidating within a large range between 4830 and 5532. This week, price action compressed even further — now sitting in the middle of that larger range, coiling into a tight triangle that could produce explosive follow-through soon.

Game Plan: Key Levels to Watch

🚨 Bearish Scenario (Monday Breakdown):

If Monday opens weak and breaks below Friday’s lows at 5285.50, that could trigger a flush toward:

5251 (Wednesday’s low)

5206 (weekly low)

And possibly 5146.75, if panic selling escalates.

📉 Breakdown Scenario Chart:

🧨 Failed Breakout Trap (Tuesday Setup):

If the bulls push higher off the open but fail to break Friday’s highs, Tuesday could offer a clean A+ short setup for traders watching that reversal closely.

📉 Failed Breakout Bull Trap Chart for short Tuesday:

🔄 Bullish Reversal (Trap & Rally):

If we break down early Monday but reclaim 5285 by the close, this becomes a failed breakdown and bear trap — clearing longs, trapping shorts, and opening the door for bulls to drive price higher with strength.

📈 Failed Breakdown Recovery Chart:

Final Thoughts: Bigger Timeframe = Bigger Opportunity

No matter which direction we break, next week’s price action will likely involve larger timeframe traders — which means bigger moves, stronger follow-through, and more opportunities for us as day traders.

That doesn’t change how I trade — I’ll still wait for my same A+ signals. But it does change my expectations for reward: this is when you want to let your winners run when the setup allows for it.

Just because there is potential for bigger moves - don’t let it sway you from your systematic trading approach or risk management system. This market is feeding off traders who are emotionally entering moves early or late. For consistent week to week success in this business, stay sharp and stay patient.

I’ll be starting next week with a neutral bias, allowing Monday’s price action to confirm direction. From there, it’s all about execution and the market giving the proper intraday setups that can lead into these bigger picture moves.

💬 For live trade alerts, real-time analysis, and in-depth daily guidance — join us in the Livestream Trading room.

💰 Save 70-90% on Apex Trader Funding with code LIVESTREAM

Apply for your funded futures trading account and get started trading with no risk other than the small cost of an evaluation account.

➡️ Sign up for your futures trading account